Blog

Indian mutual funds offer easy and cost effective way to access global markets. With India’s GDP at only 3% of the World in USD terms and 7% in PPP terms, we would be losing out on growth opportunities offered by global companies if we only invest in Indian stocks. Global funds offer additional diversification benefit to equity portfolio increasing risk adjusted returns. Opposing view can be why to invest outside when India is faster growing economy than most economies. Investment in global funds has additional currency risk as these funds invests in different currencies other than INR depending on geographies covered by the international funds. As US is the largest market by GDP as well as market capitalization, we analyse risk, return and diversification benefit of investing in US market over last 25 years. We construct S&P 500 in INR and compare it with NIFTY 50 as benchmark for India.

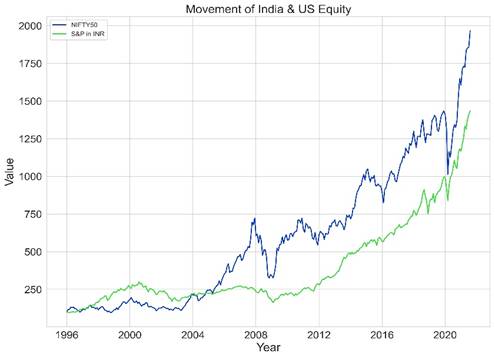

Both markets have given high returns. But India has outperformed US with CAGR of 12.3% compared to 10.9% of US. With these, investment would have grown close to 20x in India and 15x in US.

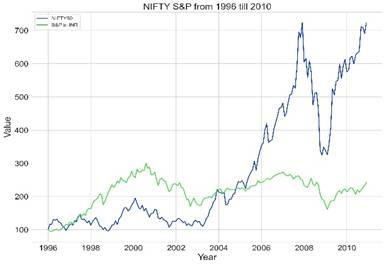

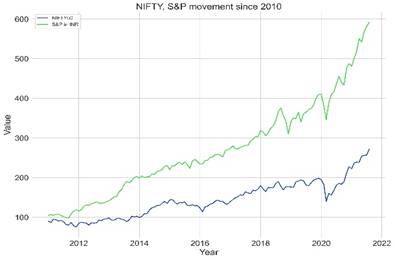

If we look the chart, we can see that while India’s growth started immediately post dot com bubble, US markets relatively languished till and then crashed with International financial crisis (also called the lost decade for US equity). But growth of US market has been very high post that. So, if we split our total 25 years period in two, pre and post 2010, we get completely opposite pictures.

India has outperformed with CAGR of 14% compare to just 6% of US in earlier period till 2010 on the back of economic reforms followed by strong GDP growth. On the contrary, US has outperformed since 2010, backed by large Fed stimuli post international financial crisis and subsequent phenomenal rise of tech stocks with CAGR of 17.3% compared to 10.5% for India. So, purely from returns perspective, results are mixed with each market outperforming in different periods.

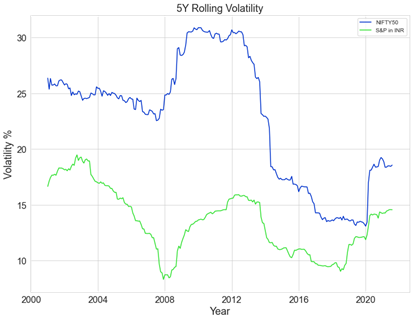

When we look at the volatility of returns, measured as standard deviation, US market clearly outperforms India and that too across the years.

However, if we look at the risk adjusted returns, measured by Sharpe Ratio, we again see India dominating till 2010 and US thereafter.

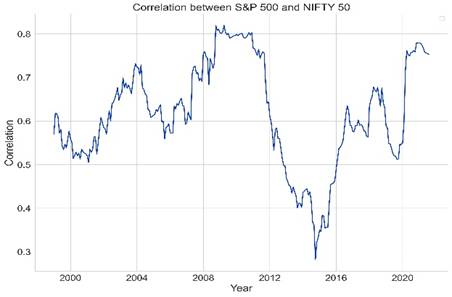

For this we need to see how returns are co-related between US and India. Visually, we can see periods with high as well as low correlation. Note the very high co-relation during financial crisis and Covid-19. As both are global events, there is no diversification benefit in crisis like these. But barring this, there is fair amount of diversification benefit by investing in US market for Indian investors.

Disclaimer: The views presented here are personal. Analysis presented is not an advice or recommendation to invest/redeem any mutual fund scheme. Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns.