Mutual Funds

With more than 40 Asset Management Companies and thousands of mutual fund scheme, selecting the right scheme is the most important step in your investment strategy.

There are primarily three asset classes for mutual fund investments:

Every asset class has different risk and return profile. Hence, it is important to understand benefits and risks associated with each of these, to make suitable investment choices.

Simply put Equity is an asset class with highest return in the long term and highest risk in the short term. It is the best route to generate long term wealth. For example, one of the top rated equity MF has given return of more than 18% p.a. To put this number in context, value of Rs. 1 lakh invested 25 years back would have increased to Rs. 65 Lakhs today.

Past performance is not indicative of future returns. However, it is important to benefit from the power of compounding that creates wealth in the long run.

Risk in Equity comes from short term fluctuation in the share prices of companies in which the mutual fund scheme has invested.

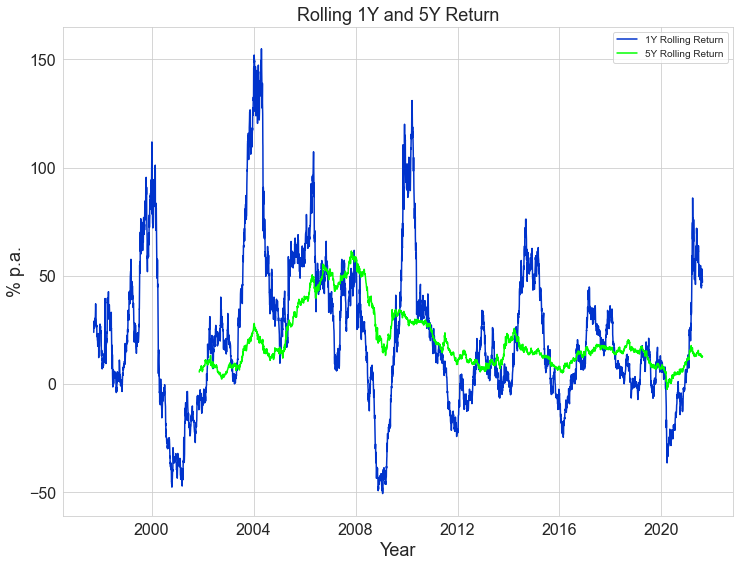

Look at the how volatile are annual return if one invest with just 1 year horizon. Three large crashes are of 40-70% are linked to dot com bubble, Internal financial crisis and more recently Covid-19.

So, how can we benefit from high returns as well as reduce risk. Answer lies in investing with longer timeframe. Volatility in returns gets substantially reduced as we increase investment horizon to 5 years. As can be seen, 5 year rolling returns mostly stayed in positive zones with much lower volatility.

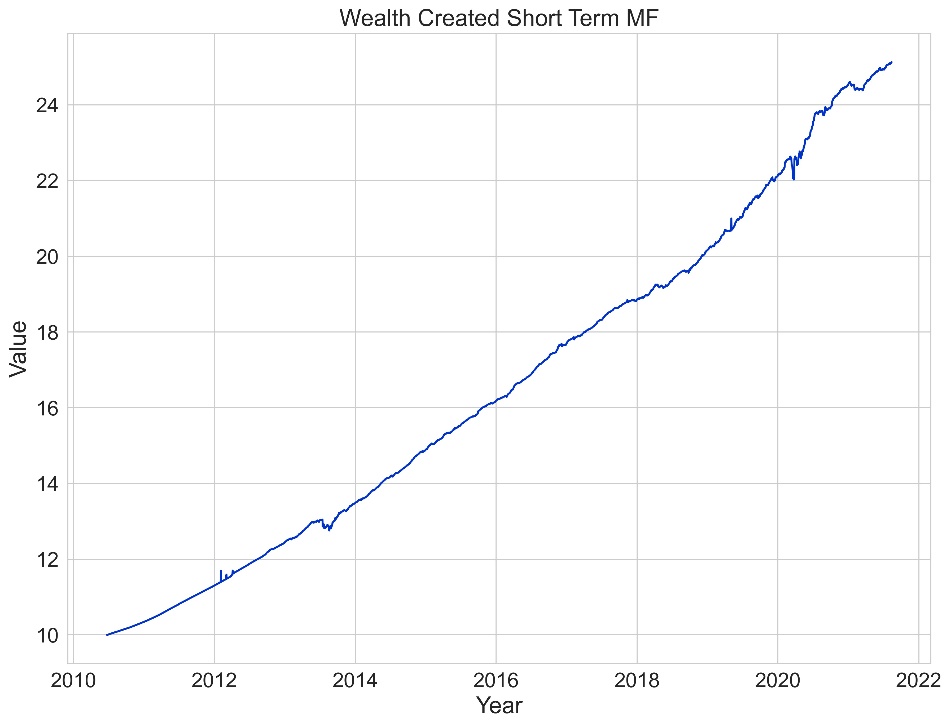

Debt funds invests in fixed income instruments in which borrower pays agreed interest tomutual funds at agreed interval, usually annual.

So, there is no is uncertainty in the cash flows which a mutual fund scheme would receive from its investments.

This nature of cashflow provides stability to the return generated by debt mutual schemes.

However, there are other risk factors namely interest rate risk and credit / default risk, which impacts the returns of debt schemes.

Interest rate risk increases as Duration of investment portfolio increases and credit risk increases if scheme invests in lower rated companies.

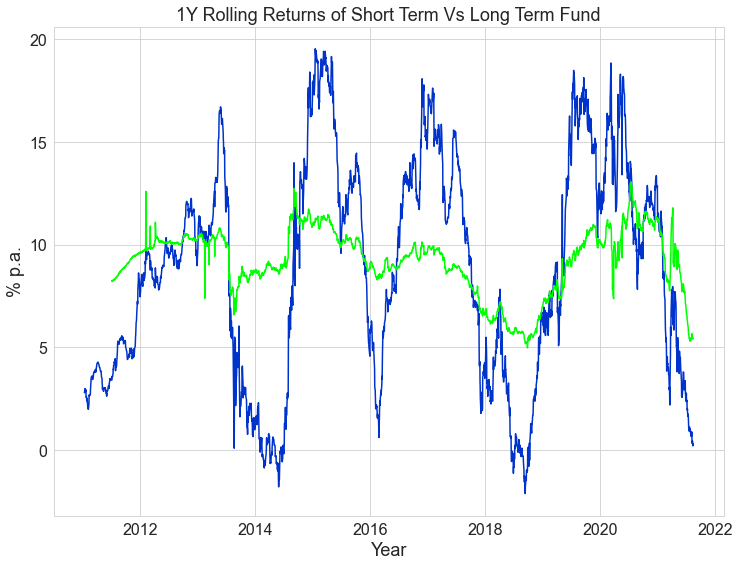

Comparison of rolling 1Y returns of a short term debt scheme and long term debt scheme shows how volatility in returns increases for longer duration funds.

Each debt mutual scheme has different interest rate risk and credit risk based on underlying investment portfolio. Understanding these risks before investment is important so that risks undertaken and returns generated are in line with expectation.

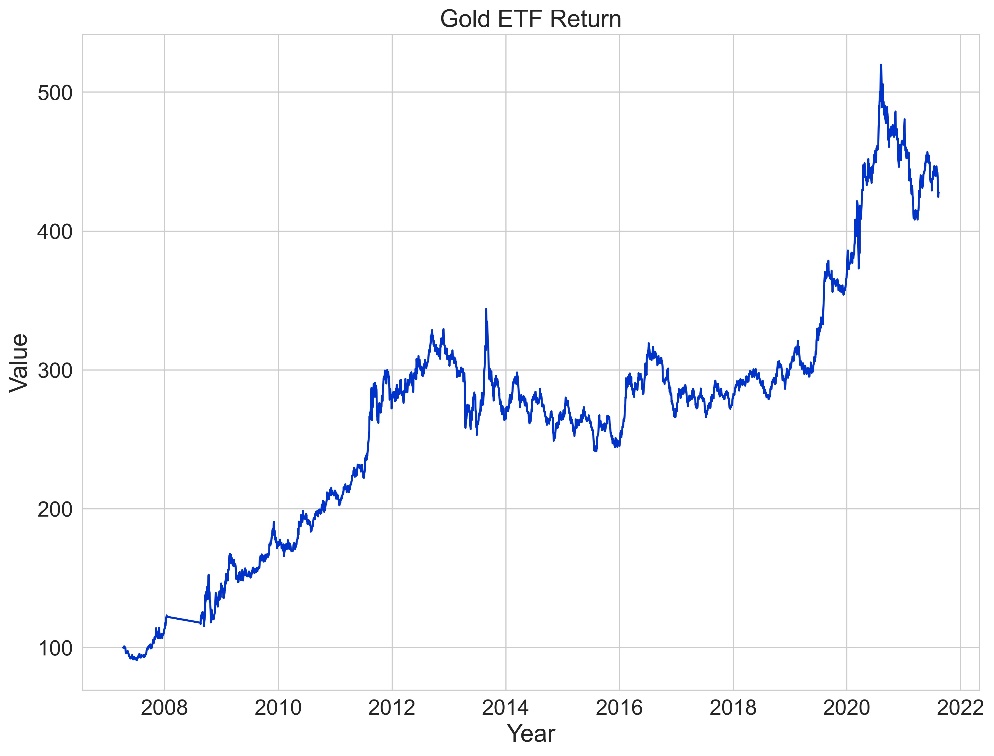

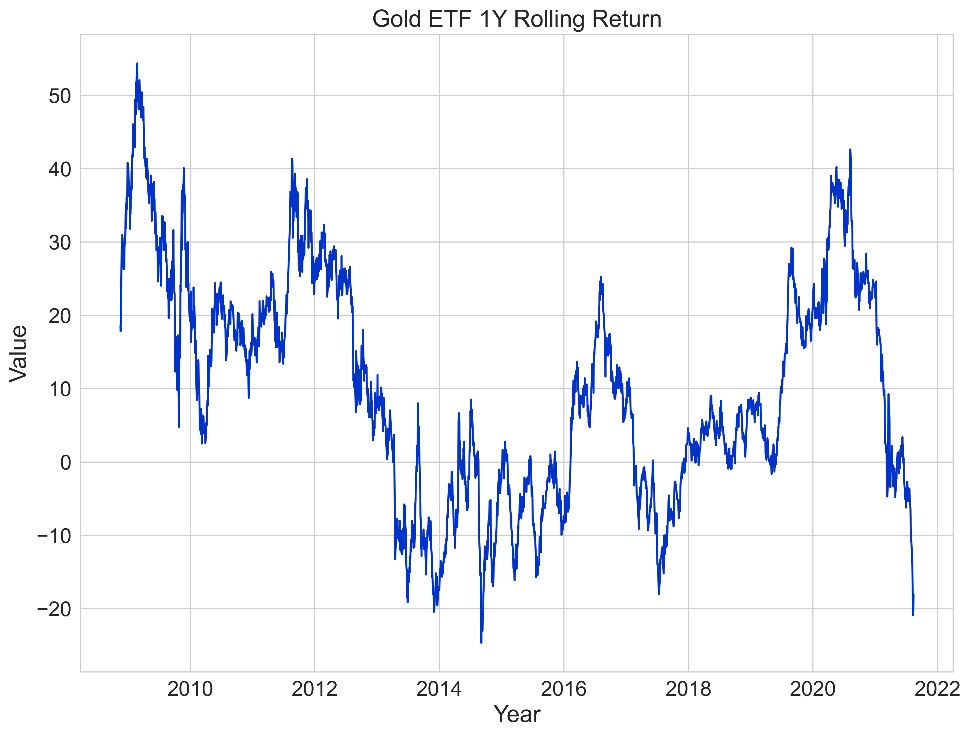

Gold is trusted by generations across the world. Gold preserves wealth by protecting against inflation as well as long term wealth creation. Contrary to popular perception, returns on gold are volatile. However, gold prices and equity are less correlated and hence allocation to gold offers diversification benefit to the investment portfolio.

Each asset class has different benefits, risks and co-relations. We harness these interactions and create unique portfolios by combining these asset classes to suit your investment objectives. We consider risk profile as well as time horizon to build suitable multi asset portfolio which can give better risk adjusted return.Sign Up to create your customized portfolio.