Blog

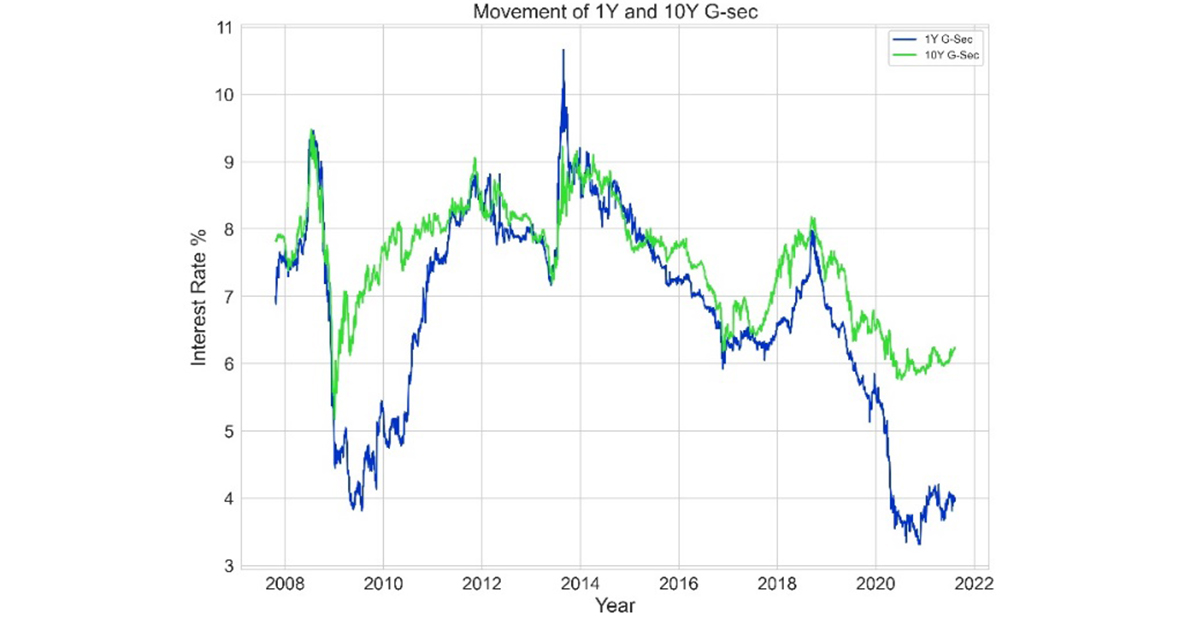

Post Covid-19, Central Banks world over provided large monetary stimulus to drive down interest rates lower. RBI followed the similar path and interest rates in India dropped to lowest levels. While RBI’s focus remains on growth and stance continues to be ‘accommodative’, market have already started pricing in rate hikes in the yield curve. Accordingly, rates have started moving up with 10Y G-Sec moving up to 6.25% p.a. from 6% p.a.

With rates bottoming out and interest rates moving up, it is important to protect debt investment from looming interest rate risks. In this context, we evaluate different debt fund categories with dual goals of protecting against interest rate risk as well as benefit from the higher interest rates.

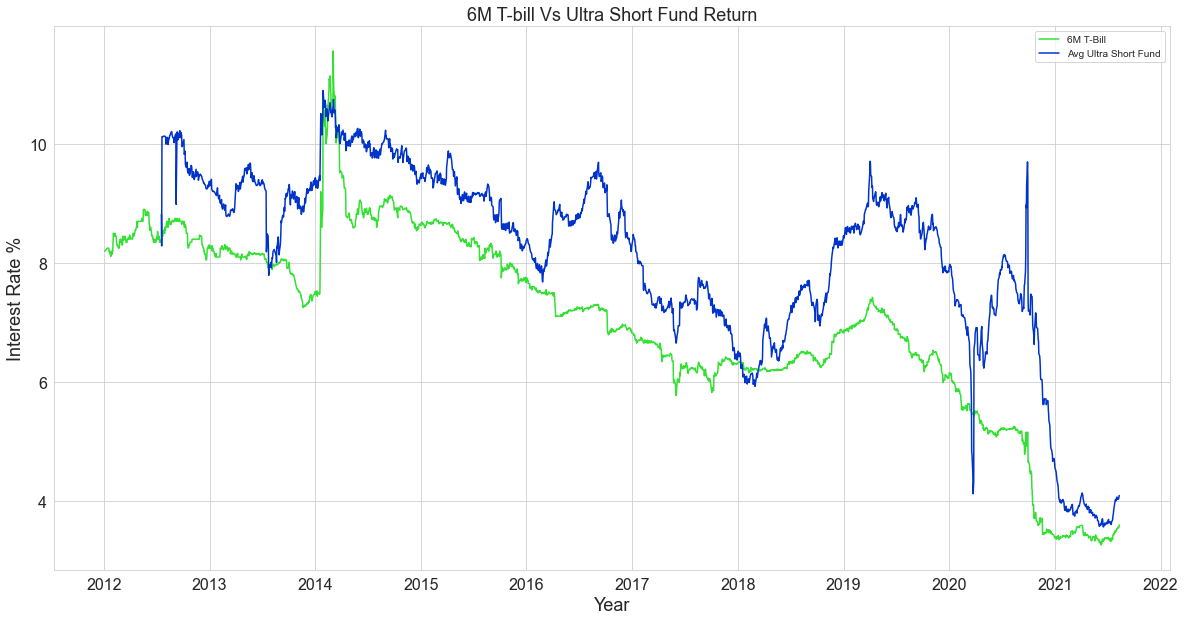

We take 6 month T-Bill rate as a benchmark for interest rate in the economy. As reset on the existing portfolio is expected to take some, we shift the benchmark curve by 6 months to compare return generated the Benchmark (effectively, holding period return for 6 months) with 6 month rolling return of the fund. In each of the categories, we take top few funds and compare their behaviour with the changes in the benchmark rates.

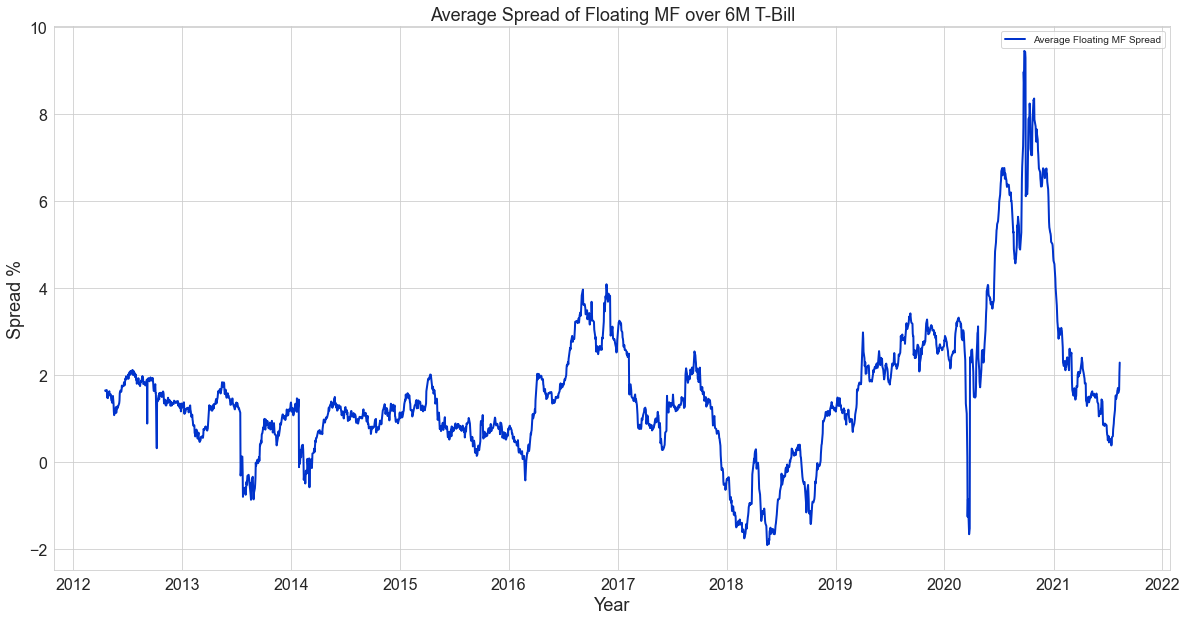

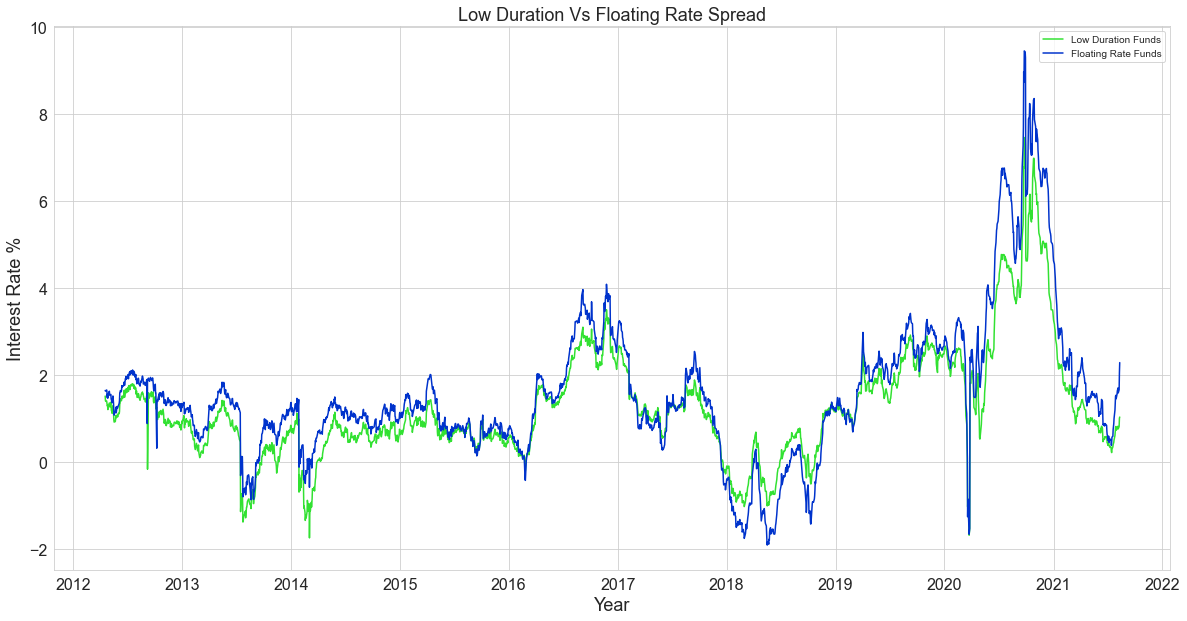

Theoretically, returns on Floating Rate Funds should change with respect to changes in the interest rates in the economy. If this is true in reality then Floating Rate funds can not only protect but actually offer higher returns as interest rate rises in the economy. We test this for floating rate schemes offered by Indian mutual funds.

We observe that returns of floating rate funds have not been tracking the benchmark in secular manner post 2016. Further, returns are very volatile compared to the movement of benchmark. The biggest drop in return is seen during 2018-19 which was the only period which saw rates moving up (apart from taper shock in 2013).

If we take average spread of all the four funds, we find that spreads have moved in relatively narrow band till 2016 (as expected from floating fund), but have been very volatile post that. It should be noted that spread was negative (returns were still positive) in 2018-19 when interest rates moved up. While there have been period of great outperformance, it is not in line with behaviour expected from floating rate funds.

The reasons for this behavour are lack of floating rate instruments in Indian debt market and so fund managers have to taketinterest rate swaps which introduces basis risk. Additionally, upto 35% portfolio can be in the fixed instruments which contributes to the higher duration and hence higher interest rate risk.

Our expectationis to protect against interest rate risks and also gain from rising interest. Both of these objectives are not being met by floating rate funds in our view.So, we look at other options.

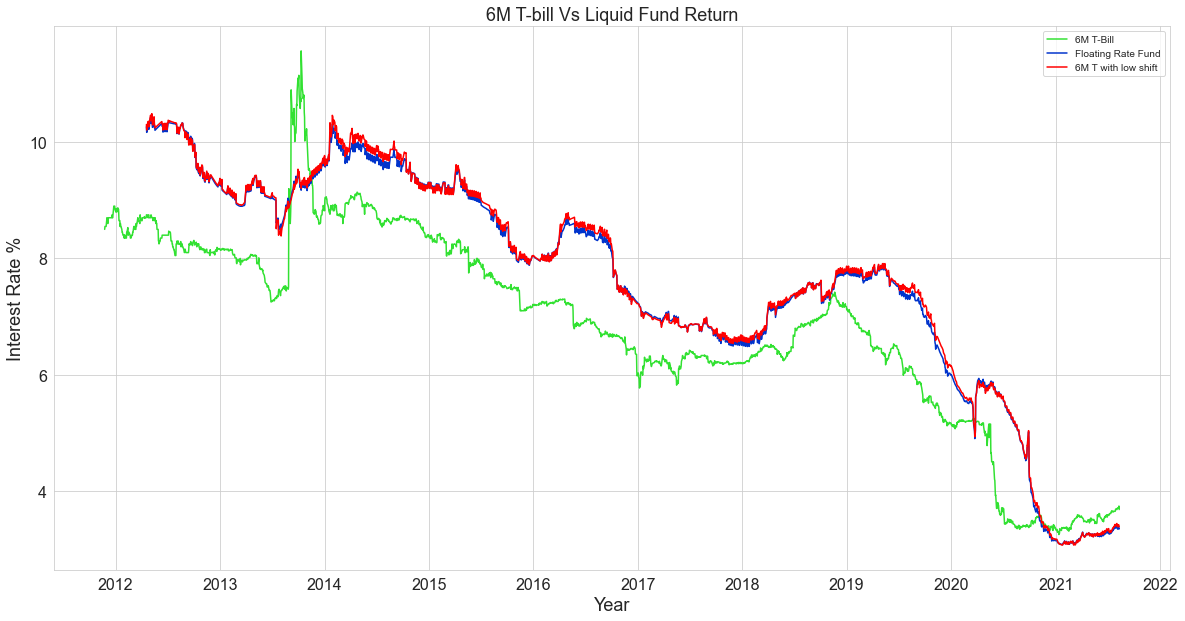

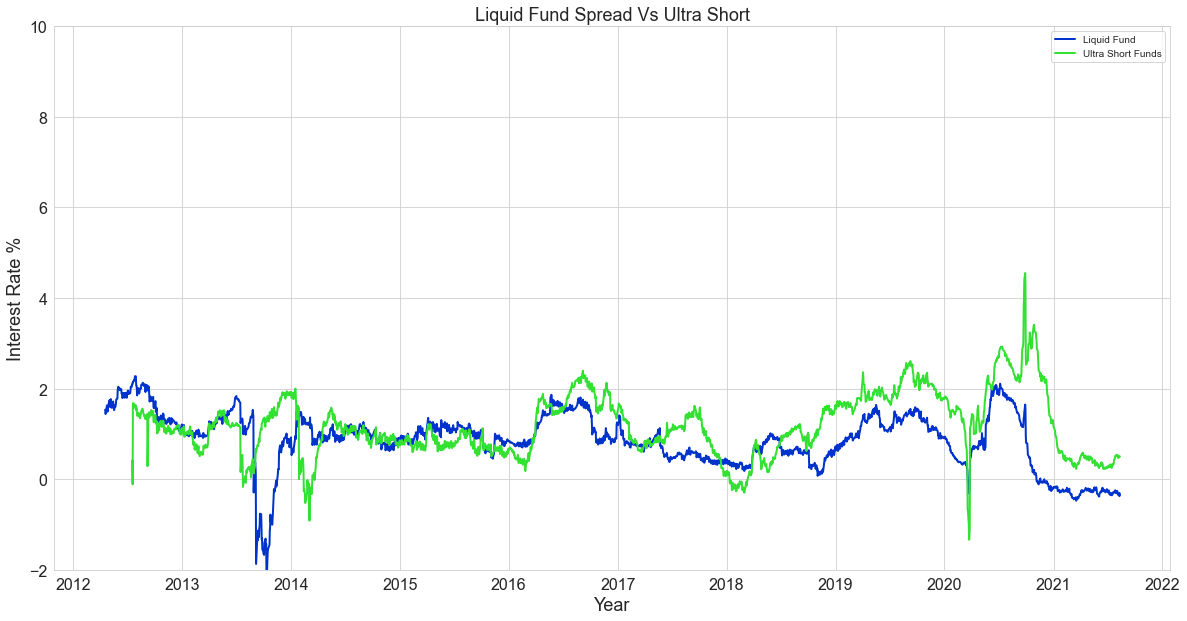

Liquids funds are very short term in nature and hence by design they are floating rate. This can be seen in close tracking of the Benchmark.

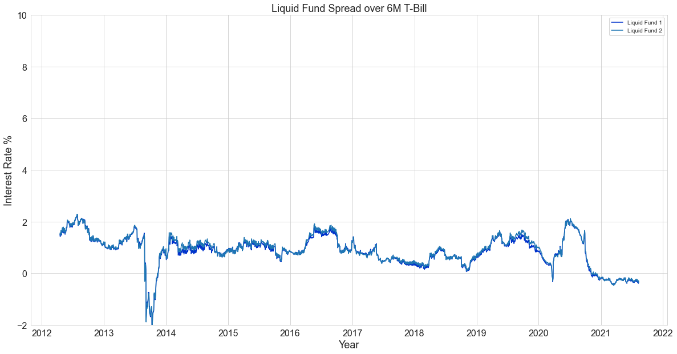

In fact, liquid funds are seen tracking the benchmark with just one month lag. This is understandable as duration of liquid funds is close to one month. Spread over Benchmark also has moved in a fairly narrow band.

We observe positive spread in year 2018-19 compared to negative in floating rate funds. So, clearly Liquid Funds offers very good protection against rising interest rates. However, absolute returns in Liquid funds are low owing to extremely short term investment portfolio. In fact it is lower than 6M T bill in 2021.

We can increase our portfolio yield by increasing our duration of funds. Let us evaluate whether we can increase our returns and still have protection from interest rate risk.

We have taken average of three leading funds so that we cancel out specific risk (diversification always helps). We oberve that Ultra Short funds have tracked the Benchmark fairly well.

Aditionally, absolute returns in 2018-19 as well as 2021 is much better than liquid funds. Hence, we consider Ultra Short as better option than Liquid.

We compare spread of Low Duration Fund over the benchmark with that of floating rate funds. Low Duration funds seems to be behaving similar to floating rate funds though they are less volatile than the latter. Considering negative spread in 2018-19, Low Duration Fund may not be able to provide protection against increasing interest rates.

Aditionally, absolute returns in 2018-19 as well as 2021 is much better than liquid funds. Hence, we consider Ultra Short as better option than Liquid.

Disclaimer: The views presented here are personal. Analysis presented is not advice or recommendation to invest/redeem any mutual fund scheme. Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns.