Mutual Funds

Simply put Equity is an asset class with highest return in the long term and highest risk in the short term. It is the best route to generate long term wealth. For example, one of the top rated equity MF has given return of more than 18% p.a. To put this number in context, value of Rs. 1 lakh invested 25 years back would have increased to Rs. 65 Lakhs today.

Past performance is not indicative of future returns. However, it is important to benefit from the power of compounding that creates wealth in the long run.

Risk in Equity comes from short term fluctuation in the share prices of companies in which the mutual fund scheme has invested.

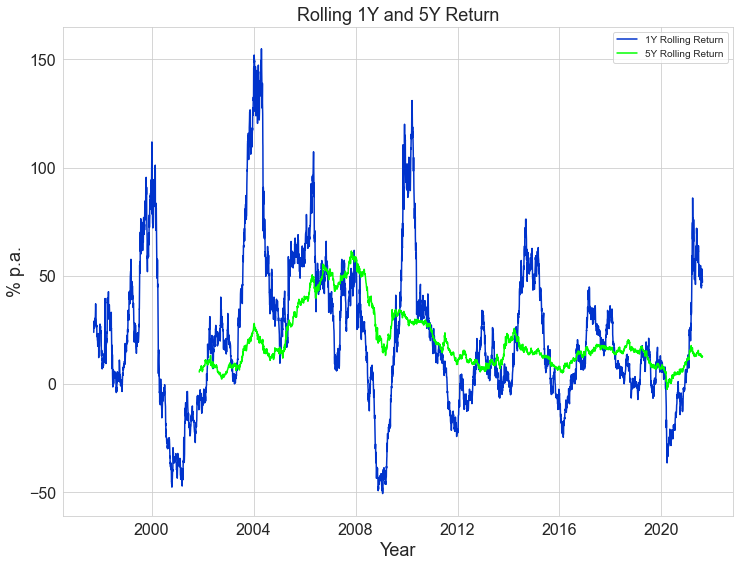

Look at the how volatile are annual return if one invest with just 1 year horizon. Three large crashes are of 40-50% are linked to dot com bubble, Internal financial crisis and more recently Covid-19.

So, how can we benefit from high returns as well as reduce risk. Answer lies in investing with longer timeframe. Volatility in returns gets substantially reduced as we increase investment horizon to 5 years. As can be seen, 5 year rolling returns mostly stayed in positive zones with much lower volatility.