Mutual Funds

Debt funds invests in fixed income instruments in which borrower pays agreed interest tomutual funds at agreed interval, usually annual.

So, there is no is uncertainty in the cash flows which a mutual fund scheme would receive from its investments.

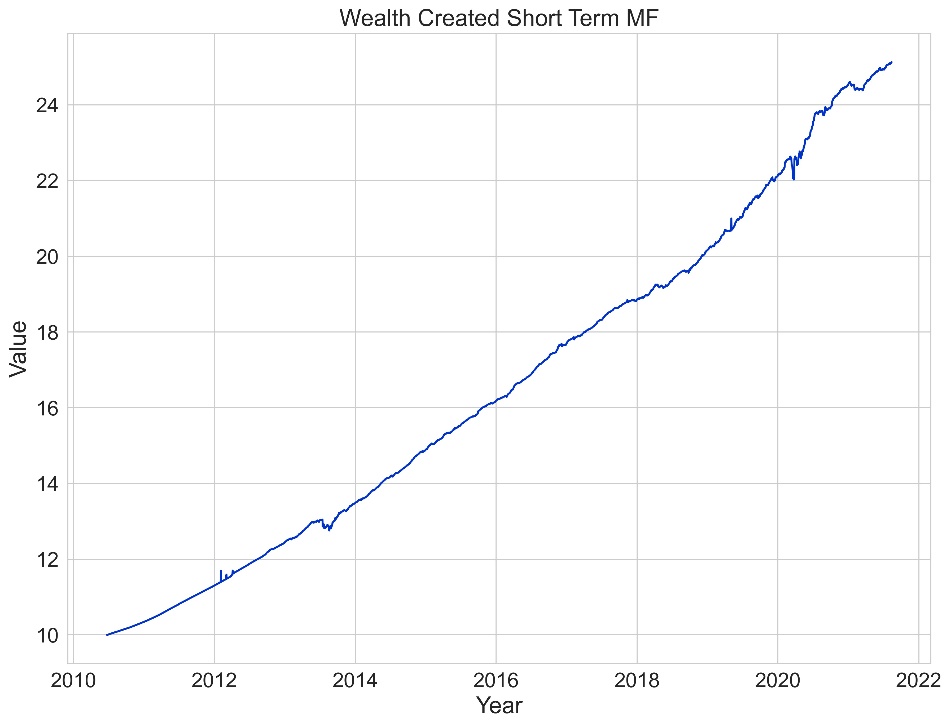

This nature of cashflow provides stability to the return generated by debt mutual schemes.

However, there are other risk factors namely interest rate risk and credit / default risk, which impacts the returns of debt schemes.

Interest rate risk increases as Duration of investment portfolio increases and credit risk increases if scheme invests in lower rated companies.

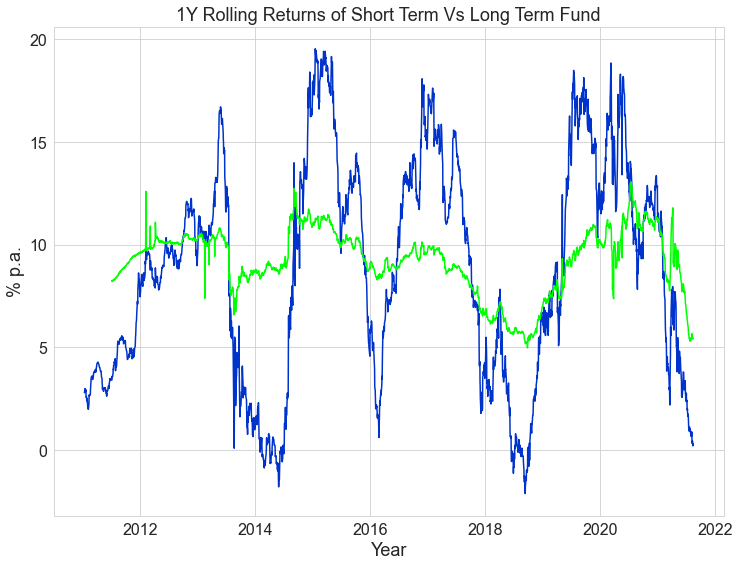

Comparison of rolling 1Y returns of a short term debt scheme and long term debt scheme shows how volatility in returns increases for longer duration funds.

Each debt mutual scheme has different interest rate risk and credit risk based on underlying investment portfolio. Understanding these risks before investment is important so that risks undertaken and returns generated are in line with expectation.